Supporting change for smooth and effective adoption.

How Allianz transformed beneficiary clauses into a commercial performance asset

Discover how a strategic integration with Testamento enabled the insurer to combine compliance, efficiency, and an enhanced customer experience.

Allianz, a leading European insurer

In France, Allianz operates as a general insurer, offering a wide range of products and services to meet the needs of individuals, professionals, businesses, and local authorities.

The French operations focus on the design, distribution, and management of insurance contracts, as well as the provision of associated services.

+ 0 M

of customers

0

billion euros in revenue

0

team members

Digitizing the beneficiary clause : Allianz’s winning bet to boost commercial efficiency

Allianz's key challenges

This project made it possible to provide, first to the Sales Advisors within the Allianz Expertise & Conseil network, and then to the network of General Agents — nearly 9,000 professionals representing the Allianz brand — a digital, secure, and user-friendly service for updating beneficiary clauses on clients’ life insurance and retirement contracts, through the “Testamento Beneficiary” solution.

Developed by Testamento, this solution features a repository of up-to-date beneficiary clauses maintained by Allianz, reflecting changes in family structures, legal doctrine, and case law.

Legal and tax

The beneficiary clause is a key component of a life insurance contract, as it determines who will receive the funds when the policyholder passes away. It plays a central role in the financial and legal issues that arise upon death.

Customer experience & support

The update of beneficiary clauses has been accelerated and secured through an educational process for clients. This improves the identification of beneficiaries. This new feature strengthens the expertise of Allianz France’s networks and their ability to support clients in passing on their assets to their loved ones.

An API-first architecture designed to meet Allianz’s IT requirements

The technical environment posed several challenges:

Seamless integration into the extensive application ecosystem,

Development of secure and robust APIs,

Connection to databases while strictly adhering to security and compliance regulations,

Creation of user-friendly interfaces tailored to the different advisor profiles.

To successfully carry out this strategic project, multiple departments were involved: Business, Legal, Operations, Distribution, and IT. Testamento’s modular solution, delivered as a turnkey SaaS and interfaced via API, enabled a gradual and controlled integration within Allianz France’s ecosystem.

A redesign of the workflows centered around seamless integration with Allianz France’s CRM system

Allianz France partnered with Testamento to digitize the management of beneficiary clauses using an API-integrated SaaS solution, seamlessly connected to its CRM and linked with an electronic signature platform.

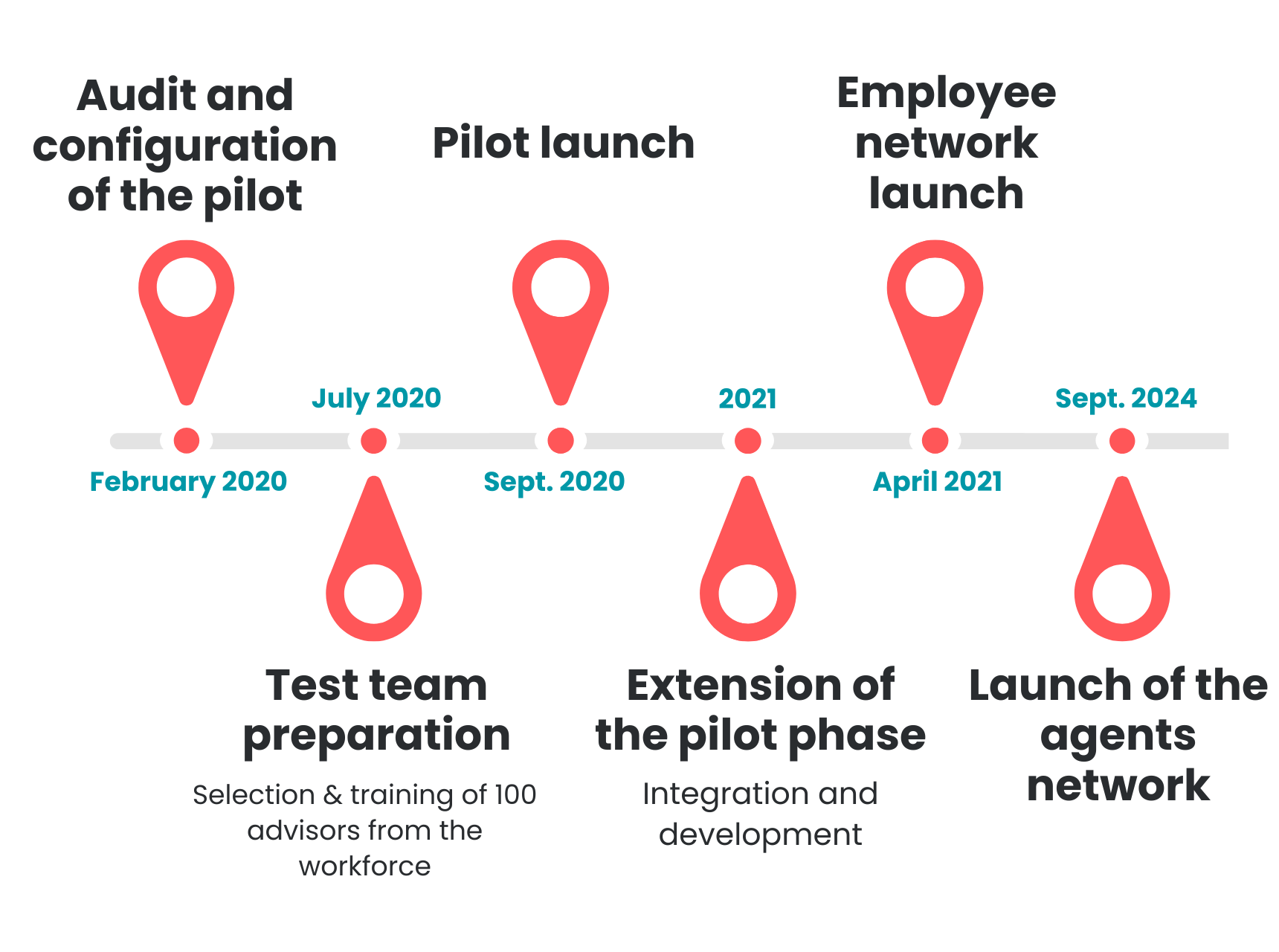

The implementation to the sales teams relied on an effective go-to-market strategy:

Interactive webinars for quick onboarding

Dedicated resources (videos, guides, FAQs)

Regular feedback sessions to gather insights from the field

Targeted Q&A sessions to tailor the tool to real needs

Allianz France: a digital client journey that shortens delays and secures clauses

The beneficiary clause management solution developed by Testamento has strengthened Allianz France’s client approach by placing the user experience at the heart of the system and creating new commercial opportunities:

Jean-Baptiste Perret Torrès – Directeur de la stratégie, de l’innovation et des fusions-acquisitions d’Allianz France

« (…) we are proud to offer our life insurance clients a simple and secure digital process for their estate planning. For the millions of life insurance holders, the importance of drafting the beneficiary clause is little known, even though it is a key element that determines who receives the funds upon the insured’s death. To address this financial and legal challenge, Allianz France and Testamento have launched an innovative digital tool for managing the beneficiary clause. For general agents and Allianz Expertise and Advice advisors, this innovative service is an additional asset to support clients, optimize the drafting of the beneficiary clause, and ensure the proper execution of the insured’s wishes. »

0 %

Advisors actively use the solution every month

+ 0 %

Generated clauses are personalized, with no legal risk whatsoever

Strong team commitment

Shortened process

Custom beneficiary clauses with complete security

Allianz France shares their testimony...

The beneficiary clause: an opportunity for insurers

In 2024, Testamento conducted an exclusive survey among the French population, revealing that the beneficiary clause remains a strategic lever still underutilized by insurers.

Discover why it represents a real business opportunity and how to turn it into a high-value advisory tool: