Average conversion rate

of an insurance lead

How an international insurer boosted lead quality with Testamento Detect

With Detect, an international insurer enhances qualified lead generation, ensures regulatory compliance, and boosts its network’s commercial performance.

An international insurer committed to quality and strong customer connections

The French subsidiary of a major American group, this insurer specializes in personal insurance. Its offering covers individual and group protection as well as loan insurance, serving individuals, professionals, and businesses.

The French entity relies on a strong network of distribution partners (brokers, independent advisors, banks).

0

dedicated

professionals in France

professionals in France

0

countries represented

The challenge: generating qualified leads in a highly competitive market

In the highly competitive French market, having qualified leads has become crucial to reduce acquisition costs, increase conversion rates, and ensure regulatory compliance (GDPR, cold calling). Investing in lead quality is now a strategic lever for profitability and differentiation.

5 - 10%

(Assurland, LesFurets)

80%

of salespeople consider lead quality the #1 success factor

(Salesforce, 2024)

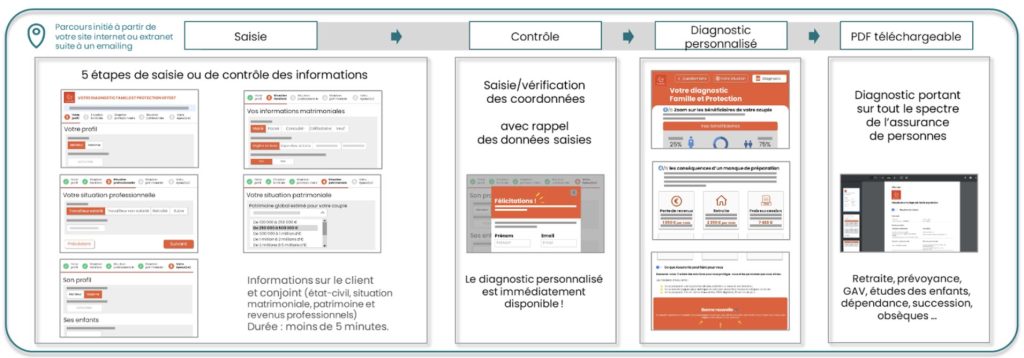

Detect, a quick, educational diagnostic to qualify leads

Testamento Detect is a white-label SaaS application, hosted and operated by Testamento, allowing individuals to receive a free, educational diagnostic of their financial situation and personal insurance needs in under 2 minutes.

“The business model allows for a quality/price ratio below the market average.”

25 - 40%

Average conversion rate with the Detect solution

depending on insurers’ operations

4X

more value for a well-targeted lead (loyalty, cross-selling)

Co-create a tailor-made journey in record time

The needs assessment was developed with the insurer’s internal teams and then refined with Testamento to design a tailored journey. The Detect solution, initially focused on savings and wealth, was specifically adapted for insurance protection.

In this project, the solution was:

Adapted to exclusively target insurance protection

Deployed with direct access from the insurer’s corporate website

Connected to Salesforce via API, enabling automatic opportunity creation

Used to generate qualified leads, which were then offered by the insurer to its network of partner brokers

A quick and efficient framework for a 100% insurance protection journey

Key adjustments included:

Creation of a dedicated insurance protection journey

Implementation of SMS verification of phone numbers before delivering the diagnostic → improving lead quality and reachability

Co-construction with the business teams to ensure alignment with existing processes

Go-live in just 6 weeks from project launch to validated, customized solution

This scoping phase allowed the alignment of the insurer’s strategic objectives with Detect’s functionalities, while ensuring compliance and the commercial relevance of the solution.

Immediate results: higher conversion rates, lower costs, improved compliance

With Detect, the insurer now has a high-performing, digital, and compliant solution that optimizes acquisition costs, enhances the customer experience, and strengthens the efficiency of its network.

+ 0 %

increase in lead conversion rate

(callback requests, online quotes)

(callback requests, online quotes)

This transformation strengthens team skills while making clients active participants in their decisions. A true success for a clear, efficient, and secure commercial approach.

- Conversion rate of journeys exceeding 20% (up to explicit request for a callback)

- Facilitated multi-holding

- 70% cost savings compared to a custom development outsourced to an external provider

- Strict compliance with regulations (GDPR, explicit consent, traceability

Concrete solutions to transform your sales journeys

From prospecting to retention: Testamento by your side

Testamento offers a comprehensive range of solutions to support insurers at every stage of the customer journey: from generating qualified leads to managing beneficiary clauses, and optimizing sales processes.

Our modular, 100% SaaS approach adapts to your needs, enhancing team efficiency, streamlining processes, and delivering a differentiated customer experience.